Don’t Let them Short-Change You – Regulator warns car finance firms over ‘lost’ data

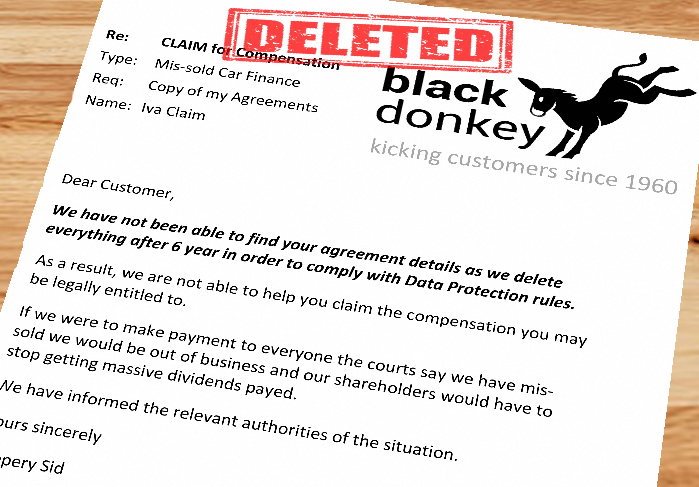

Finance companies have one goal: protect their profits. Many are now claiming they no longer have the records needed to process older cases. Industry bodies are also threatening court action in an effort to stall or shrink the scheme.

Make no mistake — lenders will try to delay, dispute, or deny valid claims to reduce payouts. Every obstacle they raise is designed to protect their bottom line, not the consumers they have mis-sold to for decades.

Drivers across the UK are owed billions in refunds for mis-sold car finance — but lenders are already preparing tactics to limit what they pay.

The Financial Conduct Authority (FCA) is proposing a compensation scheme worth up to £18bn, covering millions of car finance agreements stretching back as far as 2007. On average, drivers may be entitled to around £950 for each agreement mis-sold.

If you had a car loan, PCP, or HP agreement in the last two decades, you could be entitled to money back. But waiting for lenders to play fair could mean long delays or missed opportunities.

Act now, check if you qualify, and don’t let the finance firms decide what you’re owed.

09 Sep 2025