Regulator Consultation – what it could mean for You?

The UK regulator failed to prevent consumer harm for misold car finance for 14 years.

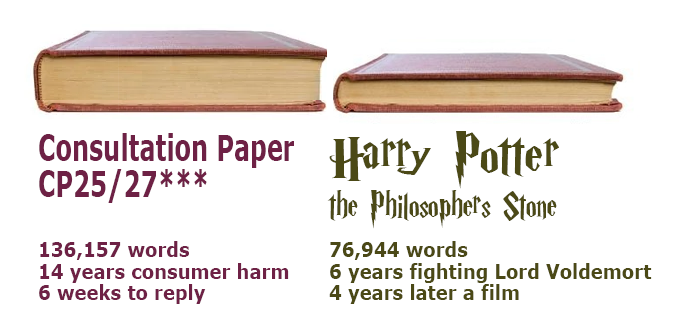

Today the same regulator published a consultation that is twice as long as the first Harry Potter book (but not such a good read) Giving just 6 weeks for comment.

The Lenders (banks) are the biggest funders of the UK regulator so it is not unexpected that they are able to influence the regulators behavior. Similar behavior was seen with PPI claims several years ago, where an unrealistic cut-off was set and the Lenders given multiple opportunities to deny claims on technical and ‘lost record’ grounds.

This suggest the regulator has already sided with the Rogue Lenders to attempt to minimise the out payments they will need to make.

Solicitors are already reporting some Lenders already ‘playing silly buggers’.

Why use a solicitor?

The regulator doesn’t represent you – it represents the industry. Its focus is managing costs, not fighting for your maximum payout.

Expertise: The CHC funding process is complex and many individuals struggle with it alone.

Success rates: Some firms report significantly higher success rates for clients who receive expert legal support compared to those who do not.

Client protection: Solicitors are regulated and carry professional indemnity insurance, providing a layer of protection if something goes wrong. They are also required to have a complaints procedure, and the Legal Ombudsman can investigate complaints.

Over 3.8 Million Car Finance Customers have already secure legal representation in the UK.

READ the Guardian Article HERE

03 Oct 2025